Crypto Market Outlook for 2025: A Cautious Perspective

Okay, let's see what the crypto markets are supposedly serving up for 2025. The overall vibe? Cautiously optimistic, sprinkled with a healthy dose of "maybe." We've got predictions, post-crash analyses, and a deep dive into Solana all fighting for attention. Time to sift through the noise.

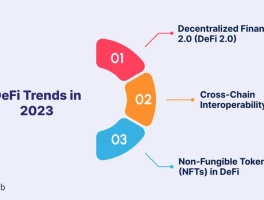

Bullish Predictions vs. DeFi Realities

The overarching narrative is bullish, sure. Bitcoin to $150k? Ethereum flirting with $5k? Solana aiming for almost $500? Everyone's got a price target, and they're mostly pointing up. But let's pump the brakes for a second. This "2025 outlook" was published back in June. A lifetime ago in crypto years. Markets move fast, and relying on mid-year forecasts now feels like navigating by an outdated map. (Remember those?)

The DeFi sector paints a different picture. A FalconX report from November 2025, shows that post-October crash, only two out of twenty-three leading DeFi tokens are actually up year-to-date. Ouch. The group's down an average of 37% quarter-to-date. That's not just a correction; that's a bloodbath. Investors are flocking to "safer names" – buybacks and tokens with "fundamental catalysts." Is this a sign of maturity, or just a desperate scramble for anything that isn't actively imploding? You can read more about these trends in DeFi Token Performance & Investor Trends Post-October Crash.

Shifts in DeFi Valuation: Lending vs. Trading

There's a shift in valuation too. Spot and perpetual DEXes are getting cheaper relative to sales, but lending and yield names are becoming more expensive. Investors are piling into lending, assuming it's stickier than trading. Maybe they're right, maybe they're just over-exposed to risk-off assets. It's hard to say.

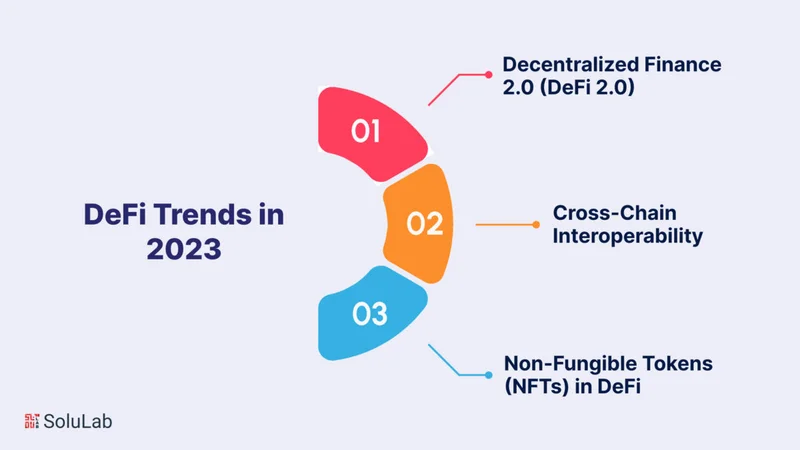

Solana's Fundamentals vs. Market Influence

And this is the part that I find genuinely puzzling. The "Solana Price Prediction" article, published this month, paints a rosy picture. 1,000+ transactions per second, near-constant uptime, expanding DeFi and NFT activity. All true, according to their data. But it also admits that Solana's price is heavily influenced by Bitcoin and Ethereum trends, and macroeconomic conditions. So, which is it? Is Solana's fate tied to its own fundamentals, or is it just riding the coattails of the bigger players? (My experience suggests the latter).

Solana: Questioning the Utility Token Narrative

Solana's got a great story. Proof of History combined with Proof of Stake, blazing fast transaction speeds, and dirt-cheap fees. It's the blockchain equivalent of a high-performance sports car. But even the best sports car is useless if there's no road to drive on. The article emphasizes SOL's utility: transaction fees, staking, ecosystem participation. But is that utility driving demand, or is speculative hype still the main engine?

Solana's Network: Decentralization Concerns

The numbers tell a mixed story. Solana's network boasts 1,295 active validators and sustains around 1,100 transactions per second. Uptime is solid, around 99.9%. But here's the rub: validator distribution is concentrated in North America and Western Europe. The high hardware requirements to be a validator — multi-core CPUs, large memory, high disk I/O — create a barrier to entry. It enables low-latency performance, sure, but it also contributes to validator concentration among well-capitalized operators. In other words, it's not as decentralized as the marketing materials might suggest.

Solana's Tokenomics: Insider Allocation and Staking Dynamics

The tokenomics are also worth a closer look. About 16% of the SOL supply went to the founders and team, and another 13% to the foundation and ecosystem. Early investors got 10%. That's almost 40% of the supply in the hands of insiders. (Not inherently bad, but something to keep in mind.) The community gets the biggest slice – about 60% – through staking rewards.

Speaking of staking, around 70% of the SOL supply is staked, earning stakers around 6-7% annually. This reduces the circulating supply, which should support the price. But inflation is still around 8% annually, gradually decreasing. It's a delicate balancing act, and if network adoption stalls, that inflationary pressure could easily outweigh the benefits of staking.

The Real Question: Is the Hype Sustainable?

So, what's the takeaway? The crypto market in 2025 is a landscape of competing narratives. Bullish forecasts clash with the harsh reality of the DeFi sector. Solana promises blazing speed and low fees, but validator concentration and inflationary tokenomics raise questions about its long-term sustainability.

The "Solana Price Outlook (2025–2030)" offers three scenarios: base, stress, and boom. Even in the "base" scenario, Solana's price is projected to reach between $150 and $220 by 2027. That's a decent return from its current levels, but it's hardly a moonshot. The analysis hinges on "ecosystem expansion, protocol upgrades, [and] increased institutional adoption." All of which are dependent on external factors.

Ultimately, the future of crypto in 2025 – and beyond – boils down to one thing: can these projects deliver real value? Can they attract sustainable adoption, not just fleeting hype? Until I see concrete evidence of that, I'm staying cautiously on the sidelines.

Vaporware Still Rules

It's the same old story with a fresh coat of blockchain paint: promises, projections, and a whole lot of speculation. Show me the real-world use cases, and then we'll talk.