Bitcoin vs. Digital Gold: The 2025 Verdict is In… Or Is It?

Here we are, hurtling towards 2026, and the question still hangs in the air like a stubborn fog: is Bitcoin really digital gold? I’ve been watching this space for years, and honestly, the back-and-forth can make your head spin. One minute, it's the revolutionary hedge against inflation, the next, it's tanking harder than tech stocks in a downturn. The market's mood swings are wild, but what about the bigger picture?

I saw a headline recently that screamed, "Bitcoin's Sharp Pullback Wipes Out Gains, Fueling Digital Gold Doubts!" And sure, that's a snapshot of a moment, but it misses the seismic shift happening beneath the surface. We're so focused on price charts that we sometimes forget the why behind it all.

Understanding the Core Value Proposition

The dream of Bitcoin as digital gold isn't just about price stability; it's about something far grander: democratizing financial power. Gold has always been a store of value, yes, but it's also been controlled by institutions, by governments, by those with the means to hoard it. Bitcoin, at its core, is about putting that power back in the hands of the people. It's about financial sovereignty.

Think about it. For centuries, gold ownership was a privilege. Now, anyone with a smartphone can own a piece of the digital pie. That's not just a technological advancement; it's a social revolution! Is it volatile? Absolutely. Is it still finding its footing? Without a doubt. But is it failing? Absolutely not. It's evolving.

The Impact of Regulatory Developments

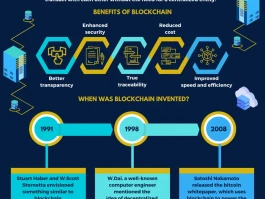

And what about the regulatory landscape? Remember when the US House of Representatives passed those three crypto bills back in mid-2025? The GENIUS Act, the CLARITY Act, the CBDC Anti-Surveillance State Act… it all felt like a turning point. Finally, some clarity! I remember thinking, "Okay, now we're talking."

One of the things that struck me was the idea that banks might soon be offering stablecoins and tokenized investments. I mean, imagine that—your everyday bank account giving you access to the world of crypto! It's a bit like the early days of the internet when suddenly everyone had access to information at their fingertips. The potential is simply enormous! But with that potential comes responsibility. We need to be vigilant about the risks, about ensuring that these new technologies are used for good and not for exploitation. This is the kind of breakthrough that reminds me why I got into this field in the first place.

The key thing is that these regulations are effective when paired with consistent and fair enforcement, as Alisha Chhangani from the Atlantic Council’s GeoEconomics Center pointed out.

Addressing the Skeptics' Concerns

Of course, not everyone is convinced. I recently came across an old interview with Nobel laureate Eugene Fama, who predicted Bitcoin would go to zero. Strong words! He basically said that cryptocurrencies "violate all the rules of a medium of exchange." And you know what? He's right... if you're looking at it through the lens of traditional finance. But that's the whole point, isn't it? Bitcoin isn't trying to be a traditional currency; it's trying to be something new.

Think of it like this: imagine someone in the 15th century scoffing at the printing press because it didn't follow the rules of handwritten manuscripts. They'd be missing the entire paradigm shift! Bitcoin is a similar leap forward, a fundamental rethinking of how we store and exchange value. And is there a potential for corruption? Of course! There are always incentives for people to corrupt any system. But that doesn't mean we should abandon the entire idea. It means we need to be smarter, more vigilant, and more committed to building a truly decentralized and equitable financial future.

The Role of Ethereum and Innovation

And it's not just about Bitcoin, either. Ethereum, with its smart contracts and decentralized applications, is pushing the boundaries of what's possible. Sure, it's more complex, more volatile but it's also a breeding ground for innovation. The shift to Proof-of-Stake was a game-changer, slashing energy consumption and paving the way for scalability. It's like switching from a gas-guzzling car to an electric one—a necessary step towards a more sustainable future.

One of the most optimistic comments that I read online was from a Redditor, who wrote, "Bitcoin isn't about getting rich quick. It's about building a better financial system for everyone." I think that sums it up perfectly.

Concluding Thoughts: Bitcoin's Current Status

So, is Bitcoin digital gold? Maybe not yet. But it is something far more important: a catalyst for change, a symbol of hope, and a reminder that the future of finance is in our hands. The track record may be mixed, as Nate Geraci, NovaDius Wealth Management president, said, but it's a long game. It's a marathon, not a sprint. As one article put it, in 2025, the leading crypto failed to answer that question of whether Bitcoin is truly digital gold.